3 Things to Know About Consumer Automotive Preferences in 2021

By Inspira Marketing

March 31, 2021

By Inspira Marketing

March 31, 2021

Over the past year, the pandemic has thrown a wrench into even the best-laid of plans. For those looking to purchase or lease a new vehicle, it’s no different. According to the 2021 Deloitte Global Automotive Consumer Study, 34% of Americans have been forced to either accelerate or slow their auto purchasing plans due to the pandemic.

While the widespread deployment of COVID-19 vaccinations signals an eventual return to normalcy, it’s important for those in the auto industry to understand how consumer preferences have shifted over the past year. Below, we take a look at three things you need to know regarding consumer sentiment in the auto industry in 2021.

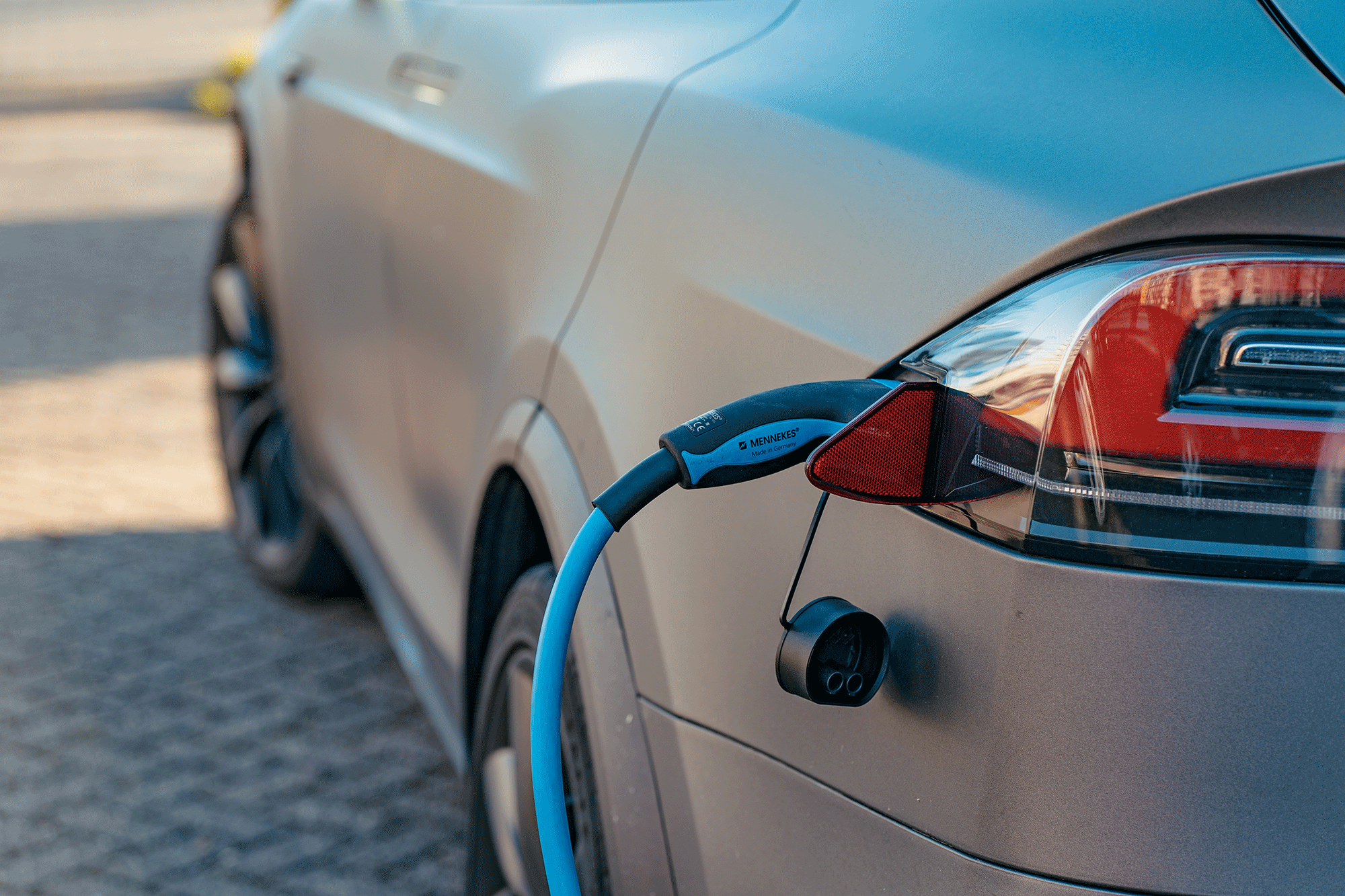

Where Consumers Stand on Electric Vehicles

In the United States, there is a strong expectation that the Biden administration will support the growth of electric vehicles – from both regulatory and incentive standpoints. However, the fact of the matter is that only 26% of Americans say they’d prefer a non-gasoline/diesel powered vehicle for their next purchase. This is a drop of 15 percentage points compared to 2020, begging the question of what could cause such a precipitous year-over-year fall.

First and foremost, the greatest concerns regarding all-battery-powered electric vehicles in the U.S. revolve around driving range (28%) and lack of charging infrastructure (25%). Even though the vast majority of consumers expect to charge their electric vehicle most frequently at home (71%), consumers need more readily available and visible charging options outside of the home to feel truly comfortable making the leap to electric.

However, these questions around infrastructure and driving range aren’t new to the past year, and, therefore, aren’t likely causes of the YoY drop in purchase intent. Instead, look to the 20% of consumers whose greatest concern about electric vehicles is the price premium associated with them. As more options become available from OEMs, electric vehicles should become accessible at lower price points. For now, though, the financial ramifications of the pandemic are suppressing interest.

Safety Features and Financing

While electric vehicles are not on everyone’s shopping lists, safety features are of the utmost importance for the majority of consumers. When asked which advanced features they’d want in their next vehicle, seven in ten consumers pointed to blind spot alerts — the highest demand for any individual feature. Beyond blind spot warnings, the safety theme continues. Sixty percent of consumers want automatic emergency braking, while 59% clamor for lane departure warnings.

In terms of how consumers pay for a vehicle, the pandemic has caused 10% of consumers to request a payment deferment this year — with that number spiking to 23% among those between the ages of 18 and 34. Accordingly, 43% of consumers say that getting the lowest available rate for their credit rating is the most important thing related to their loan or lease. After that, convenience (33%) and ease of payment process (29%) are the top needs for consumers.

The Hold-Up on Virtual

The pandemic has certainly accelerated the trend towards e-commerce, but not everyone is flocking to buy their vehicle on Carvana just yet. Seventy-one percent of consumers say they’d like to purchase their next vehicle in person, while remaining consumers seek either a fully virtual (17%) or partially virtual (12%) purchase process. Even for those looking to buy virtually, they are most likely to entrust an authorized dealer (59%) or the manufacturer itself (27%).

Ultimately, the sticking point for most consumers is rather simple: they’re uncomfortable purchasing a vehicle before they see (75%) and test drive it (64%). For OEMs, dealers, and third-party sellers, it will be important to communicate policies around those specific concerns in order to assuage fears. Likewise, they’ll want to lean in on the positives; unsurprisingly, convenience (34%), speed (21%), and ease of use (19%) are the top reasons that would cause consumers to purchase a vehicle online.

Is your brand looking to connect with auto buyers in the coming year? Contact us today to learn how our integrated brand experiences can help you build affinity with car-buying consumers and earn lifelong loyalists.

{{cta(‘61004bdb-f2f4-4c7f-b7ea-e57bed292904’)}}

Sources: “2021 Global Automotive Consumer Study.” Deloitte (2021), “What are the top automotive trends for 2021?” Automotive World (2021).