Infographic: A Glance at the Cannabis Consumer

By Inspira Marketing

November 8, 2019

By Inspira Marketing

November 8, 2019

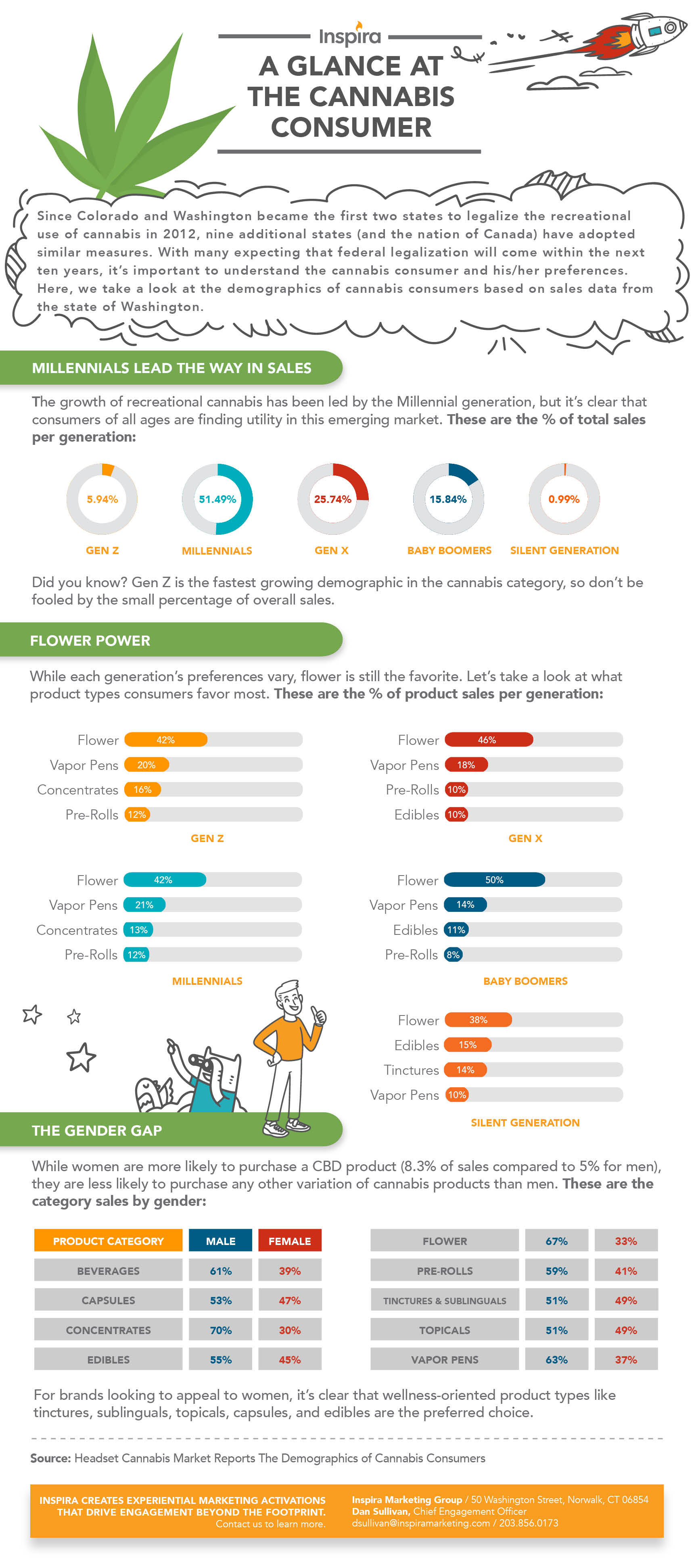

Since Colorado and Washington became the first two states to legalize the recreational use of cannabis in 2012, nine states (and the nation of Canada) have adopted similar measures. With many expecting that federal legalization will come within the next ten years, it’s important to understand the cannabis consumer and his/her preferences. Here, we take a look at the demographics of cannabis consumers based on sales data from the state of Washington.

Here are three things you need to know about today’s cannabis consumer:

Millennials Lead the Way in Sales

The growth of recreational cannabis has been led by the Millennial generation, but it’s clear that consumers of all ages are finding utility in this emerging market. These are the percentages of total sales by generation:

Did you know? Gen Z is the fastest growing demographic in the cannabis category, so don’t be fooled by the small percentage of total sales at this time.

Flower Power

While each generation’s preferences vary, flower is still the favorite. Let’s take a look at what product types consumers favor most. These are the percentages of product sales by generation:

The Gender Gap

While women are more likely to purchase a CBD product (8.3% of sales compared to 5% for men), they are less likely to purchase any other variation of cannabis products than men. These are the category sales by gender:

For brands looking to appeal to women, it’s clear that wellness-oriented product types like tinctures, sublinguals, topicals, capsules, and edibles are the preferred choice.

Is your brand looking to connect with cannabis consumers? Contact us today to learn how our suite of experiential-led services can help you build brand awareness, encourage product trial, and earn lifelong loyalists.