Infographic: Understanding Millennials and Money

By Inspira Marketing

September 10, 2018

By Inspira Marketing

September 10, 2018

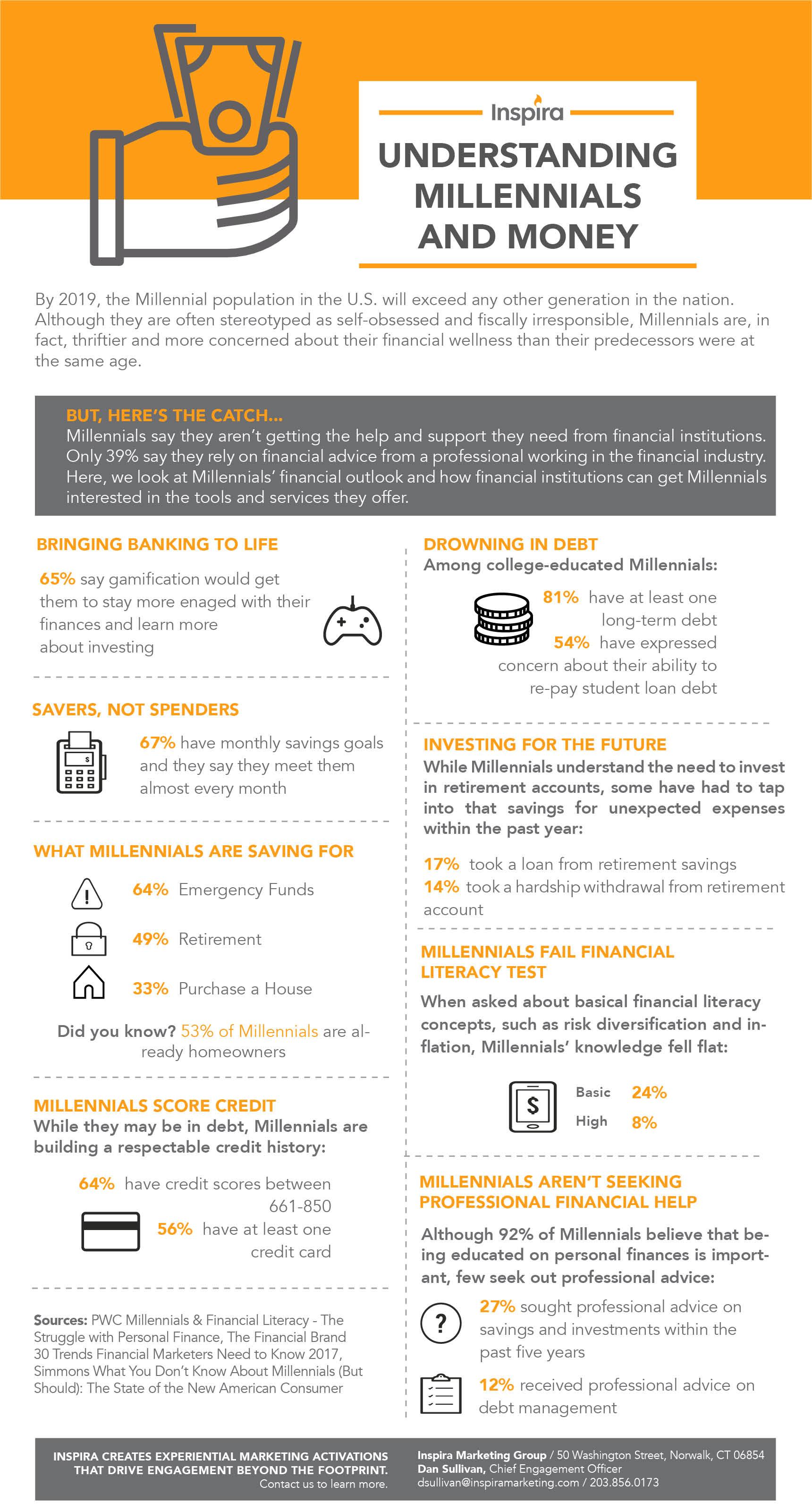

By 2019, the Millennial population in the U.S. will exceed any other generation in the nation. Although they are often stereotyped as self-obsessed and fiscally irresponsible, Millennials are, in fact, thriftier and more concerned about their financial wellness than their predecessors were at the same age.

However, Millennials say they aren’t getting the help and support they need from financial institutions – only 39% say they rely on financial advice from a professional working in the financial industry. Here, we look at Millennials financial outlook and how financial institutions can get Millennials interested in the tools and services they offer.

Here are five facts you need to know about Millennials’ financial habits when creating your next experiential marketing campaign.

Bringing Banking to Life

Millennials want financial institutions to make banking less boring

65% say gamification would get them to stay more engaged with their finances and learn more about investing

Savers Not Spenders

67% of Millennials have monthly savings goals – and they say they meet them almost every month

What Millennials Are Saving For

64% emergency funds

49% retirement

33% purchase a house

Did you know? 53% of Millennials are already homeowners

Drowning in Debt

Among college-educated Millennials

81% have at least one long-term debt

54% have expressed concern about their ability to re-pay student loan debt

Millennials Score Credit

While they may be in debit, Millennials are building a respectable credit history

64% of Millennials have credit scores between 661-850 56% have at least one credit card

Contact us today to learn how our team can help you reach Millennials with your next campaign.