Infographic: What’s Winning Over Consumers in Financial Services?

By Inspira Marketing

October 16, 2019

By Inspira Marketing

October 16, 2019

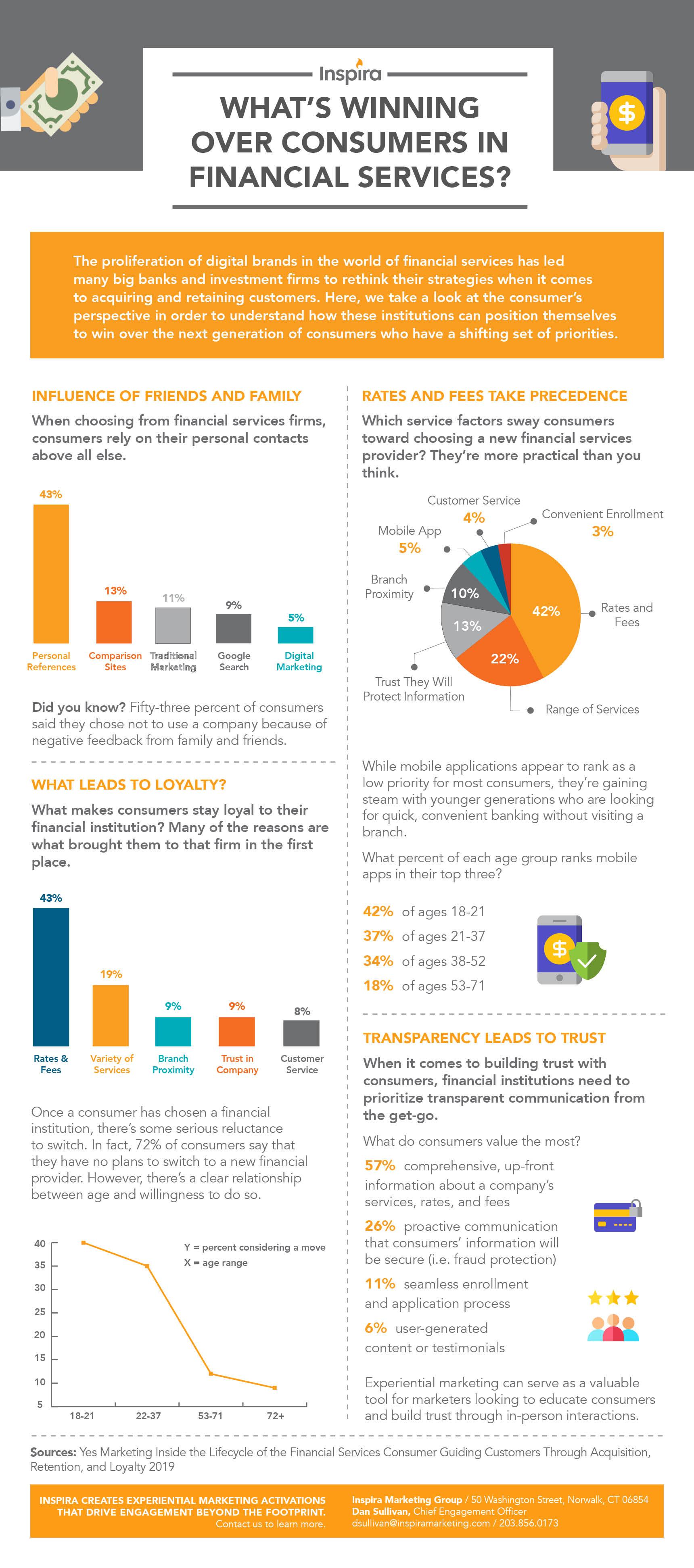

The proliferation of digital brands in the world of financial services has led many big banks and investment firms to rethink their strategies when it comes to acquiring and retaining customers. Here, we take a look at the consumer’s perspective in order to understand how these institutions can position themselves to win over the next generation of consumers with a shifting set of priorities.

Here are four things you need to know about the future of financial services:

Influence of Friends and Family

43% personal references

13% comparison websites

11% traditional marketing

9% google search

5% digital marketing

Did you know? Fifty-three percent of consumers said they chose not to use a company because of negative feedback from family and friends.

Rates and Fees Take Precedence

42% of consumers say that the biggest consideration is how their rates and fees compare to those of rival companies

22% the services provided (direct deposit, online bill pay, investment services, mortgage loans, student loans, card loans)

13% trust that the company will protect their information

10% proximity of physical branches

5% ability to manage services via a mobile app

4% reputation for good customer service

3% convenient enrollment or application process

While mobile applications appear to rank as a low priority for most consumers, they’re gaining steam with younger generations who are looking for quick, convenient banking without visiting a branch. What percent of each age group ranks mobile apps in their top three?

42% of ages 18-21

37% of ages 21-37

34% of ages 38-52

18% of ages 53-71

What Leads to Loyalty?

43% how rates and fees compare to other financial services companies

19% variety of services available

9% proximity of physical branches

9% trustworthiness of the company

8% quality of customer service

Once a consumer has chosen a financial institution, there’s some serious reluctance to switch. In fact, 72% of consumers say they have no plans to switch to a new financial services provider. However, there’s a clear relationship between age and willingness to do so.

40% of 18-21 year olds considering a move

35% of 22-37 year olds

12% 53-71

9% 72+

Transparency Leads to Trust

What do consumers value the most?

57% comprehensive, up-front information about a company’s services, rates, and fees

26% company proactively communicates that their information will be secure (fraud preventing services, etc.)

11% seamless enrollment / application process

6% user-generated content or testimonials

Experiential marketing can serve as a valuable tool for marketers looking to educate consumers and build trust through in-person interactions.

Contact us today to learn how our suite of experiential-led marketing services can help you educate consumers, build brand awareness, and earn lifelong loyalists.