Infographic: Why Are Millennials Avoiding Credit Cards?

By Inspira Marketing

March 21, 2019

By Inspira Marketing

March 21, 2019

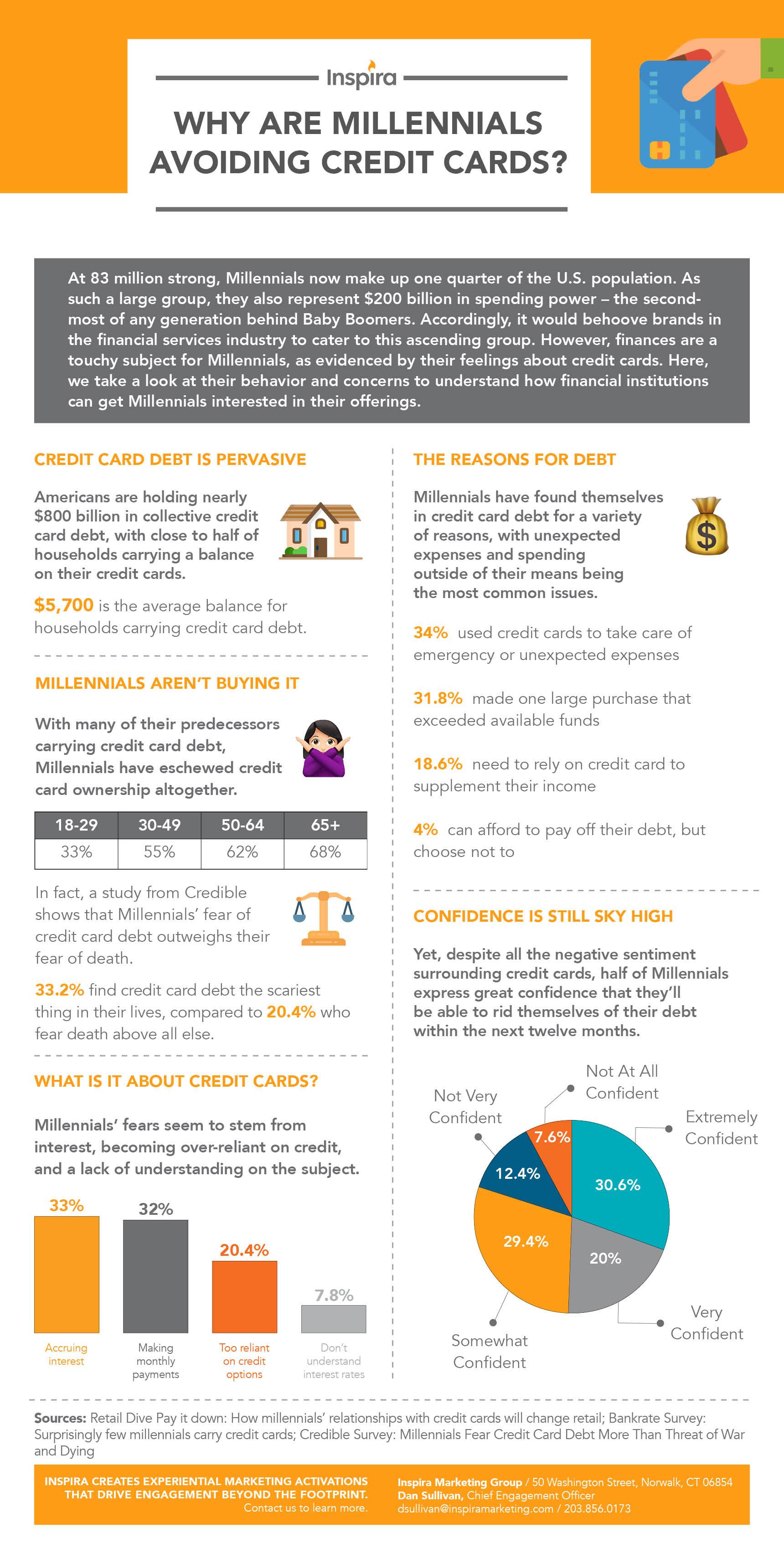

At 83 million strong, Millennials now make up one quarter of the U.S. population. As such a large group, they also represent $200 billion in spending power – the second-most of any generation behind Baby Boomers. Accordingly, it would behoove brands in the financial services industry to cater to this ascending group. However, finances are a touchy subject for Millennials, as evidenced by their feelings about credit cards. Here, we take a look at their behavior and concerns to understand how financial institutions can get Millennials interested in their offerings.

Here are five facts you need to know about Millennials and their relationship with credit cards:

Credit Card Debt is Pervasive

$5,700 is the average balance for households carrying credit card debt

Millennials Aren’t Buying It

18-29 – 33%

30-49 – 55%

50-64 – 62%

65+ – 68%

35.2% find credit card debt the scariest thing in their lives, compared to 20.4% who fear death above all else

What Is It About Credit Cards?

33% accruing interest

32% making monthly payments

20.4% too reliant on credit options

7.8% don’t understand interest rates

The Reasons for Debt

34% used credit cards to take care of emergency or unexpected expenses

31.8% made one large purchase that exceeded available funds

18.6% need to rely on credit card to supplement their income

4% can afford to pay off their debt, but choose not to

Confidence is Still Sky High

30.6% Extremely confident that they’ll be able to pay off debt in the next 12 months

20% Very confident

29.4% Somewhat confident

12.4% Not very confident

7.6% Not at all confident

Contact us today to learn how our team can help you reach Millennials with your next campaign.